2023–24 Departmental Plan

The original version was signed by

The Honourable Chrystia Freeland P.C, M.P.

Deputy Prime Minister and Minister of Finance

On this page

- From the Director and Chief Executive Officer

- Plans at a glance

- Planned spending and human resources

- Corporate information

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: definitions

2023–24 Departmental Plan (PDF Version, 3.0 MB)

From the Director and Chief Executive Officer

I am pleased to present to Parliament and Canadians the 2023–2024 Departmental Plan for the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), which sets out our priorities for the upcoming year. As Canada’s Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) regulator and financial intelligence unit, we are at the heart of Canada’s multi-agency AML/ATF Regime and we play an essential role in helping to combat money laundering, terrorist activity financing and threats to the security of Canada.

FINTRAC operates in a challenging environment with new technologies and financial products, the rapidly shifting nature of global financial systems, and geopolitical events constantly shaping our work. Our financial intelligence is more critical than ever to the success of Canada’s AML/ATF Regime as criminals and terrorists look to use increasingly sophisticated methods and professional facilitators to exploit vulnerabilities and take advantage of any opportunity to enrich themselves and advance their illicit enterprises.

Over the coming year, as part of our core regulatory and financial intelligence mandates, we will work to broaden and enhance our strategic engagement with our many stakeholders – our regulatory partners, Canada’s law enforcement and national security agencies, thousands of businesses across the country and our international allies – to improve our collective understanding of emerging threats and strengthen our collective ability to combat money laundering and terrorist activity financing at home and abroad.

Our successful public-private partnerships are one important way that FINTRAC and our strategic partners are having a real and meaningful impact in protecting some of Canada’s most vulnerable citizens. This year, we will advance our first international public-private partnership aimed at targeting the laundering of proceeds associated with illegal wildlife trade, a major transnational organized crime that poses a serious environmental, economic, security and public health threat in Canada and around the world.

As we focus on becoming Canada’s AML/ATF regulator of the future, we will continue to prioritize our Centre-wide modernization efforts, with a particular emphasis on how we conduct our business with our stakeholders and the systems and tools that we use on a daily basis. In preparing for the introduction of a cost recovery funding model for our Compliance Program, which is expected to begin on April 1, 2024, we have launched a modernization initiative aimed at ensuring our compliance activities are more targeted and agile in meeting the diverse needs, expectations and capacities of all business sectors. Our objective is to make it simpler for businesses to fulfil their legal obligations by providing meaningful support, refined processes, service and tools, among other efficiencies.

In looking to leverage innovation and digital modernization, we are positioning FINTRAC as an agile organization that is able to keep up with an ever-changing and increasingly challenging AML/ATF environment. Key to our efforts is the ongoing implementation of our multi-year Digital Strategy, which is helping us to transform the Centre into a leading digital organization. Our strategy is concentrated on delivering client-centric solutions for both internal and external stakeholders based on the use of new and emerging digital technologies that add business value, improve performance, enhance digital services and enrich the user experience. For example, with the new resources that FINTRAC received in Budget 2022, we are upgrading our Intelligence sector’s analytics suite to ensure that our financial intelligence is even more timely and responsive in support of the complex money laundering and terrorist financing investigations of Canada’s law enforcement and national security agencies.

Finally, our enhanced engagement and collaboration with our strategic partners domestically and internationally will provide us with important feedback as we prepare for the upcoming legislative review of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act in 2023 and the Financial Action Task Force mutual evaluation thereafter. We will use this valuable information to pursue efficiencies, address areas for improvement and leverage the best practices of partners to enhance the operational alignment and effectiveness of FINTRAC and the Regime as a whole.

As we begin a new fiscal year, I would like to thank our talented and dedicated employees for their hard work and the critical contributions they make to protecting Canadians and the integrity of Canada’s financial system. I am proud to work with such diverse and capable professionals who are recognized here in Canada and internationally for their knowledge, expertise and commitment to the global fight against money laundering and the financing of terrorism.

______________________________

Sarah Paquet

Director and Chief Executive Officer

Plans at a glance

FINTRAC’s strategic priorities are built on a foundation of three pillars that, combined, promote its vision of contributing to the safety of Canadians and the security of the economy, as a trusted leader in the global fight against money laundering and terrorist activity financing.

Inside the overarching pillars of 1) Promote a culture of accountability; 2) Prepare FINTRAC for the future; and 3) Collaborate to strengthen results, FINTRAC’s Strategic Plan articulates six priorities that are summarized below, along with some of the key strategic actions that enable the Centre to realize its vision.

Pillar 1: Promote a culture of accountability

FINTRAC’s objective is to have a resilient, agile workforce accountable for achieving the Centre’s priorities within a culture that values diversity, collaboration, civility and ethical behaviour.

| FINTRAC Priorities | Strategic Actions |

|---|---|

| Maximize the potential of our people |

|

| Ensure transparency through results and performance |

|

Pillar 2: Prepare FINTRAC for the future

FINTRAC’s objective is to maintain a work environment that promotes innovation and provides the support and tools, especially information and data, to deepen the Centre’s analysis and approaches.

| FINTRAC Priorities | Strategic Actions |

|---|---|

| Modernize the workplace |

|

| Explore and implement innovative solutions |

|

Pillar 3: Collaborate to strengthen results

FINTRAC’s objective is to leverage the knowledge and expertise of our domestic and international partners in influencing changes to the way we detect and deter money laundering and terrorist activity financing.

| FINTRAC Priorities | Strategic Actions |

|---|---|

| Cultivate strategic relationships with key external stakeholders |

|

| Strengthen cross-government cooperation |

|

As a small agency, FINTRAC embraces the concept of ‘innovation’ through its enhanced commitment to modernize and evolve its operational programs and internal services activities. In 2023–24, FINTRAC is committed to exploring new collaboration and work arrangements within Canada's AML/ATF Regime, and through public and private partnerships with its major reporting entities in the fight against money laundering and terrorist activity financing.

For more information on FINTRAC’s plans, see the “Core responsibilities: planned results and resources” section of this plan.

Core responsibilities: planned results and resources

This section contains information on the department’s planned results and resources for each of its core responsibilities.

Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

Description

FINTRAC is responsible for ensuring compliance with Part 1 and Part 1.1 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its associated Regulations. This legal framework establishes obligations for reporting entities to develop and implement a compliance program in order to identify clients, monitor business relationships, keep records and report certain types of financial transactions. FINTRAC undertakes enabling and enforcement actions to ensure that the reporting entities operating within Canada's financial system fulfill their PCMLTFA obligations. These obligations provide important measures for countering patterns and behaviours observed in criminals and terrorists in order to deter them from operating within the legitimate channels of Canada's economy. FINTRAC also maintains a registry of money services businesses in Canada and foreign money services businesses that direct and provide services to persons and entities in Canada.

Planning highlights

FINTRAC’s compliance framework is based on three complementary pillars: assistance, assessment and enforcement. Collectively, these pillars form a comprehensive, risk-based approach aimed at influencing compliance behaviour whereby persons and entities subject to the PCMLTFA fulfill their obligations. Central to this are a host of activities aimed at ensuring that reporting entities understand and comply with their ‘know-your-client’ and record keeping requirements, and that they submit high quality and timely reports to FINTRAC.

Maintaining an effective compliance framework requires the right suite of policies and procedures, supported by the right systems and training mechanisms, together with a capacity to evolve within a complex and dynamic operating environment. In 2023–24, FINTRAC plans to undertake the following major activities:

- FINTRAC will work closely with the Department of Finance Canada, other regime partners, foreign financial intelligence units and international organizations to help enhance global knowledge of money laundering and terrorist activity financing issues and to combat the threat posed by these and other financial crimes. Priorities will include supporting the work of the Financial Action Task Force (FATF), the Asia/Pacific Group (APG), of which Canada is a member, and the Caribbean Financial Action Task Force (CFATF), of which Canada is a cooperating and supporting nation. This work will help improve international standards, knowledge of money laundering and terrorist activity financing, and policies for the future.

- The FATF sets international standards that aim to prevent money laundering and terrorist activity financing and the harm they cause for society. The FATF conducts peer review of each member country to assess levels of implementation of the FATF recommendations, providing an in-depth description and analysis of each country’s method for preventing criminal abuse of the financial system. As the fifth round Mutual Evaluation of Canada’s AML/ATF regime is currently expected to be discussed at the FATF plenary in June 2026, FINTRAC will actively support a number of initiatives led by the Department of Finance Canada, including a self-assessment of the regime. The Centre will also advance a number of internal activities to prepare for the review, for which international assessment could begin in early 2025.

- To enable ongoing collaboration and to establish innovative partnerships with domestic stakeholders, FINTRAC will seek to advance the work of the Public-Private Collaboration Steering Committee (PPCSC). The PPCSC is co-chaired by FINTRAC and brings together senior level executives from key federal partners and seven of Canada’s largest banks. The Committee serves as a forum to support regime opportunities for experimentation by undertaking projects, within existing authorities, to find ways to maximize the use and analyses of data, as well as enhance and improve information sharing across Canada’s AML/ATF regime by leveraging new methods and technologies such as algorithms to identify likely high-risk transactions and collaborative threat assessment models. FINTRAC will continue to advance clear operational examples on issues such as private to private and private-public information sharing, and will work with PPCSC, academia and other stakeholders to explore potential policy, process and technology options to enhance this type of information sharing.

- As a partner in the Government of Canada’s five-year National Strategy to Combat Human Trafficking, which includes prevention and addressing gender-based violence and supporting the safety and security of Indigenous peoples, FINTRAC will explore how private to private information sharing can further enhance the detection, prevention and deterrence of money laundering related to human trafficking.

- FINTRAC will continue to work closely with the Department of Finance Canada and other key stakeholders throughout the development and implementation of the Centre’s cost recovery funding model. As part of the implementation plan, FINTRAC will continue to finalize the business processes and develop the tools for operationalizing the new funding model, including any technology solutions that may be required. The associated Assessment of Expenses Regulations that will enable FINTRAC to recover the full costs of its Compliance Program from the persons and entities it supervises and regulates is anticipated to come into force on April 1, 2024. FINTRAC is committed to ensuring strong administration of cost recovery and continued transparency.

- FINTRAC as a whole has embarked on a series of modernization efforts. A major focus will be to continue to move forward with the modernization of its principally compliance-led activities to ensure that they are targeted and agile in meeting the diverse needs, expectations and capacities of all reporting entity sectors. Innovation across the financial sector continues to challenge traditional regulatory models. In response, the Centre launched a multi-year Compliance modernization initiative called R.I.S.E. (Respond, Innovate, Strategize, Evolve) meant to ensure that FINTRAC’s workforce is prepared and equipped for new ways of working that will allow it to keep pace with the innovative technologies that businesses are using and looking to implement. As part of this modernization initiative, FINTRAC will explore and pursue measures and activities that will equip the Centre and its people with more process automation, new digital tools and advanced data management solutions to keep up with the innovative technologies that reporting entities are using, supported by investments in recruitment, skills development and retention to ensure FINTRAC has the workforce it needs.

- FINTRAC will work closely with the Department of Finance Canada to implement legislative and regulatory amendments that will expand the coverage of the PCMLTFA obligations to armoured car services and mortgage lenders. Along with the Department of Finance, FINTRAC will support Innovation, Science and Economic Development Canada on the implementation of a publicly accessible beneficial ownership registry. Similarly, FINTRAC will work closely with the Bank of Canada in the implementation of the new Retail Payment Activities Act and associated framework.

- FINTRAC will support the Department of Finance Canada in identifying and assessing opportunities to address legislative and regulatory gaps as part of the Parliamentary Review process assessing the PCMLTFA, which is expected to begin in earnest in 2023.

- To enable reporting entities in meeting their obligations, FINTRAC will provide ongoing guidance and support through conferences, working groups, training sessions, policy interpretations, as well as through collaboration with industry associations and other regulators. In particular, FINTRAC will engage with sectors that are newly covered under the PCMLTFA obligations to ensure that the requirements are understood and being implemented appropriately. FINTRAC will also experiment with new ways to provide strategic guidance to its reporting entities along with new online educational products, some of which will be targeted at specific reporting entity sectors.

- In 2023–24, FINTRAC will continue to implement its “Compliance made simple” philosophy, recognizing that reporting entities, other government agencies, law enforcement and national security agencies, all share a common interest in — and responsibility for — creating a financial system free from criminal abuse. FINTRAC will support, collaborate with, and build the capability of the reporting entity population to ensure they have access to tools, guidance and information that allows them to play an active role in preventing, detecting, deterring and responding to threats of criminal abuse and exploitation. In the years to come, key investments will be made to enhance engagement and support reporting capabilities for Canadian businesses by introducing new online educational products, automated onboarding tutorials that are sector-specific, to assist reporting entities in meeting their obligations. FINTRAC will continue to provide guidance and support through conferences, working groups, policy interpretations, as well as through collaboration with industry associations and other regulators.

- Resulting from work done on Project Protect (a public-private partnership that developed financial indicators to help identify money laundering associated with human trafficking), FINTRAC was introduced to the Financing Against Slavery and Trafficking – Survivor Inclusion Initiative, which brings together a dedicated coalition of financial institutions and survivor support organizations to facilitate survivor access to basic banking services, such as chequing and savings accounts, and to help survivors become full financial participants in their communities. A gender-based analysis and community consultation revealed that women and girls are most often victims of human trafficking for the purpose of sexual exploitation. Traffickers often confiscate the personal effects of their victims, including identification documents and bank cards, as an added measure of control. As part of the Initiative, FINTRAC’s Compliance Program is working with banks and the Financial Consumer Agency of Canada to provide explicit guidance to reporting entities on how they can ensure compliance with the PCMLTFA and associated Regulations when an individual may not have identification documents. This initiative supports women and girls as they reintegrate into society by removing barriers that impact their ability to build independent lives, free from exploitation.

Innovation

New technologies have the potential to make AML/ATF measures faster, cheaper and more effective. FINTRAC is strongly committed to keeping abreast of innovative technologies and business models in the financial sector, including experimenting with regulatory technology (RegTech) and supervisory technology (SupTech). Experimentation is a way to address new and emerging risks, as well as explore ways to reduce administrative burden on Canadian businesses who must comply with our legislation. The way ahead is to promote responsible innovation by engaging and collaborating with our domestic and international partners for information exchange, as well as forging alliances with academic institutions. FINTRAC will also focus on recruiting for new skills in the area of RegTech and developing its employee capacity to innovate and work with new and emerging technologies to facilitate data collection, processing and analysis. As part of its Digital Strategy, the Centre will also increase its use of digital solutions and experiment with artificial intelligence and machine learning, to streamline and enhance internal processes and inform its oversight of regulated entities, helping to improve supervision.

To effectively and efficiently deliver the outcomes identified in the FINTRAC Digital Strategy and progress further through automation of the Centre’s core business and digital office, FINTRAC is embracing product management. In 2023–24, FINTRAC will continue implementation of a Product Management approach and begin evaluating its level of success in delivering a complete agile lifecycle management of the Centre’s products and services, with the goal of building business value, reducing pain points for Canadian businesses who are required to report under our legislation and addressing the needs of specific target segments. FINTRAC’s implementation of a product management approach is currently supporting the agile development of new business tools, with the objective of ensuring delivery of value and benefits through iterative prototyping, helping define FINTRAC’s product development roadmap and achieve faster delivery of enterprise capabilities.

Planned results for Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

The following table shows, for Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations, the planned results, the result indicators, the targets and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2019–20 actual result |

2020–21 actual result |

2021–22 actual result |

|---|---|---|---|---|---|---|

| Reporting entities are compliant with Anti-Money Laundering and Anti-Terrorist Financing obligations and requirements | Percentage of assessed reporting entities not requiring enforcement actionFootnote 1 | 90% | March 31, 2024 | Not applicableFootnote 2 | 94% | 94% |

| Percentage of financial transaction reports submitted to FINTRAC that meet validation rules as an indicator of quality | 90% | March 31, 2024 | 88.1%Footnote 3 | 88% | 87% |

The financial, human resources and performance information for FINTRAC’s program inventory is available on GC InfoBase.

Planned budgetary spending for Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

The following table shows, for Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) |

2023–24 planned spending |

2024–25 planned spending |

2025–26 planned spending |

|---|---|---|---|

| $29,671,676 | $30,819,567 | $32,130,619 | $32,309,829 |

Financial, human resources and performance information for FINTRAC’s program inventory is available on GC InfoBase. It is anticipated that the methodology to present the Compliance Program’s planned spending may change as part of key mandatory reporting requirements in preparation to implement cost recovery in 2024–25.

Planned human resources for Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

The following table shows, in full time equivalents, the human resources the Centre will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents |

2024–25 planned full-time equivalents |

2025–26 planned full-time equivalents |

|---|---|---|

| 179 | 152Footnote 4 | 152 |

Financial, human resources and performance information for FINTRAC’s program inventory is available on GC InfoBase.

Production and Dissemination of Financial Intelligence

Description

FINTRAC is mandated by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) to produce actionable financial intelligence that assists Canada's police, law enforcement, national security and other international and domestic partner agencies in combatting money laundering, terrorism financing and threats to the security of Canada, while protecting the personal information entrusted to FINTRAC. The Centre also produces strategic financial intelligence for federal policy and decision-makers, the security and intelligence community, reporting entities across the country, international partners and other stakeholders. FINTRAC’s strategic intelligence provides a wide analytical perspective on the nature, scope and threat posed by money laundering and terrorism financing.

Planning highlights

As part of its core mandate, FINTRAC provides actionable financial intelligence to Canada’s police, law enforcement and national security agencies, domestic securities regulators or international financial investigators and Financial Intelligence Units (FIUs) to help them combat money laundering, terrorism financing and threats to the security of Canada.

Given the complexity of connecting the flow of illicit funds often involving organized criminal groups, FINTRAC’s financial intelligence very often contains hundreds or even thousands of financial transaction reports in each disclosure. A financial intelligence disclosure may show links between individuals and businesses that have not been identified in an investigation, and may help investigators refine the scope of their cases or shift their sights to different targets. A disclosure can pertain to an individual or a wider criminal network, and can also be used by law enforcement to put together affidavits to obtain search warrants and production orders. FINTRAC’s financial intelligence is used in a wide variety of criminal investigations related to the funding of terrorist activities and the laundering of proceeds originating from such crimes as drug trafficking, fraud, tax evasion, corruption and human trafficking.

FINTRAC’s financial intelligence can also be used to reinforce applications for the listing of terrorist entities and advance the government’s knowledge of the financial dimensions of threats, including organized crime and terrorism.

FINTRAC’s financial intelligence also plays a role in advancing and supporting innovative public-private sector partnerships. These partnerships are currently aimed at more effectively combatting money laundering in British Columbia and across Canada, human trafficking in the sex trade, romance fraud, the trafficking of illicit fentanyl, the laundering of proceeds of crime related to illicit cannabis, and child sexual abuse material on the Internet. By partnering with Canadian businesses, police and law enforcement agencies across Canada, FINTRAC has been effective in following the money to identify potential subjects, uncovering broader financial connections and providing intelligence to advance national project-level investigations.

In addition to the Centre’s financial intelligence disclosures, FINTRAC also produces valuable strategic financial intelligence to fulfill its mandate. Strategic intelligence employs research and analytical techniques to identify emerging characteristics, trends and tactics used by criminals to launder money or fund terrorist activities. This analysis provides insight into the nature and extent of money laundering and terrorist activity financing in Canada and throughout the world. Among Canada’s security and intelligence community, as well as regime partners and policy decision-makers, the Centre’s strategic intelligence helps inform operational and policy decisions across the AML/ATF Regime by surfacing key trends and developments from a dynamic and evolving environment. For the businesses and individuals that make up the reporting entities in Canada’s AML/ATF Regime, strategic intelligence is a key source of information guiding the measures they take to detect the presence of money laundering and terrorist activity financing. And strategic intelligence is the core method by which the Centre delivers on its objective to enhance public awareness and understanding of matters related to money laundering and the financing of terrorist activities.

In 2023–24, the following activities will be undertaken:

- FINTRAC will generate and disclose actionable financial intelligence to support major, resource intensive investigations, and hundreds of other individual investigations at the municipal, provincial and federal levels, including those conducted by law enforcement, national security agencies as well as other agencies designated to receive intelligence such as Revenue Québec and the Competition Bureau.

- As FINTRAC looks to strengthen collaboration and build innovative partnerships with stakeholders, priority will be given to supporting FINTRAC’s highly successful, industry-led, public-private partnerships (PPPs). In 2023–24, FINTRAC will advance new collaborations, such as an international PPP to address money laundering derived from illegal wildlife trade, which is the fourth largest criminal industry in the world after drugs, arms and human trafficking, and a PPP with industry to address the laundering of proceeds of crime associated with illegal online gaming.

- In addition, FINTRAC will actively engage with the Financial Crime Coordination Centre (FC3), which brings together dedicated experts from across intelligence and law enforcement agencies to strengthen inter-agency coordination and cooperation and to identify and address significant money laundering and financial crime threats. FINTRAC will also contribute its expertise and insight to the Canada Border Services Agency led multi-disciplinary Trade Fraud and Trade-Based Money Laundering Centre of Expertise.

- FINTRAC will continue to develop and deepen its Strategic Intelligence Program through reports and analysis that inform federal regime partners and the security and intelligence community on priority areas of money laundering and terrorist activity financing, such as developing trends related to professional money laundering, the emerging role of virtual currencies, the misuse of corporate structures, and the financing of ideologically motivated violent extremists. These insights will represent key pieces of a broader puzzle that result in better operational and policy decisions through a more thorough understanding of the complex and always evolving money laundering and terrorist financing context.

- In the year ahead, FINTRAC will continue to participate in the Counter Illicit Finance Alliance of British Columbia, a cross-sectorial partnership that collaborates in the development of strategic information in the interest of protecting the economic integrity of British Columbia through the prevention, detection, and deterrence of illicit financial activity.

- Building on the success of the 2022 Sectoral and Geographic Advisory on Underground Banking through Unregistered Money Services Businesses, FINTRAC will continue to invest analytical resources in 2023–24 into the production of such advisories. By identifying sectors or geographic areas more at risk from specific money laundering or financing of terrorist activities typologies, reporting entities will better understand the measures they can take to address and mitigate these issues.

- Effective management of FINTRAC's data assets is critical to the production of actionable financial intelligence. In 2023–24 and beyond, FINTRAC will explore new analytical methods and techniques, as well as best practices employed in other jurisdictions, to maximize the value derived from existing data holdings and will seek to augment data sources to enhance its strategic intelligence products and operational activities.

Innovation

FINTRAC will advance targeted investment projects to enrich the toolkit available to enhance the quality of financial intelligence output. In 2023–24, FINTRAC will complete phase one of its intelligence suite renewal program and finalize the agile vendor procurement process, resulting in contract award and proof of concepts for new, automated, Intelligence capabilities. FINTRAC will then embark into phase two of this program which includes implementation of these proofs of concepts. The approach will strengthen FINTRAC’s ability to assess vendor capabilities and allow for the adoption of modular solutions that will better integrate with FINTRAC’s analytical system, reduce risk of failure, and achieve faster delivery of enterprise capabilities.

Planned results for Production and Dissemination of Financial Intelligence

The following table shows, for Production and Dissemination of Financial Intelligence, the planned results, the result indicators, the targets and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2019–20 actual result |

2020–21 actual result |

2021–22 actual result |

|---|---|---|---|---|---|---|

| FINTRAC's tactical financial intelligence disclosures inform investigative actions | Percentage of feedback from disclosure recipients that indicates that FINTRAC’s financial intelligence disclosure was actionable | 85% | March 31, 2024 | 97% | 96% | 97% |

| FINTRAC's strategic financial intelligence informs policy and decision-making | Percentage of Regime partners using FINTRAC products to inform activitiesFootnote 5 | 70% | March 31, 2024 | Not applicableFootnote 6 | 70% | 72% |

The financial, human resources and performance information for FINTRAC’s program inventory is available on GC InfoBase.

Planned budgetary spending for Production and Dissemination of Financial Intelligence

The following table shows, for Production and Dissemination of Financial Intelligence, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) |

2023–24 planned spending |

2024–25 planned spending |

2025–26 planned spending |

|---|---|---|---|

| $24,152,373 | $25,102,235 | $28,266,275 | $28,326,978 |

Financial, human resources and performance information for FINTRAC’s program inventory is available on GC InfoBase.

Planned human resources for Production and Dissemination of Financial Intelligence

The following table shows, in full time equivalents, the human resources the Centre will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents |

2024–25 planned full-time equivalents |

2025–26 planned full-time equivalents |

|---|---|---|

| 154 | 154 | 143 |

Financial, human resources and performance information for FINTRAC’s program inventory is available on GC InfoBase.

Internal Services: planned results

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Planning highlights

FINTRAC’s Internal Services support the Centre's core responsibilities and programs. A key priority is ensuring the protection of personal information entrusted to the Centre. All facets of FINTRAC's operations are subject to rigorous security measures that ensure the safeguarding of the Centre's physical premises and IT systems, including the handling, storage and retention of all personal and other sensitive information under its control. Internal Services also support the development and delivery of effective and integrated services, policies, advice and guidance in the fields of finance, human resources, culture and change management, security, communication, procurement, administration, information management, and information technology. The overall objective is to ensure that FINTRAC has the proper capacity and corporate infrastructure to allow its workforce to achieve operational success.

As FINTRAC's responsibilities and operations continue to grow in scope and complexity, its ability to deliver on its mandate remains directly tied to its adaptability, the skills and dedication of its employees, and the tools and resources available for them to do their work. As an organization committed to excellence, FINTRAC is focused on the effective management of its human, technological and financial resources, and will continue to enhance its security program, including strengthening its security screening capacity and cybersecurity, while also reinforcing the physical security of the facilities in light of the ever-changing threat landscape.

To achieve its Internal Services objectives, FINTRAC will undertake the following activities in 2023–24:

- FINTRAC will continue to implement its People and Culture Strategy 2019–24 with a focus on the areas of talent acquisition, talent management, enterprise learning, functional architecture and organizational design, and total compensation. Activities in support of the Strategy that are planned for 2023–24 include:

- Moving forward with the HR Modernization initiative aligned with our People and Culture High Impact Operating Model that will equip the Centre and its people with more process automation/self-serve options and new digital tools, including the implementation of a new Human Capital Management system, to support and enable our people management framework, programs and services.

- Implementing FINTRAC’s newly modernized talent acquisition and management approach, which is outcome centric and will support agility, flexibility, and increased accountability.

- Continuing with targeted and proactive talent acquisition strategies and initiatives such as virtual career fairs, targeted recruitment campaigns, as well as enhanced strategies to maximize student recruitment.

- Continuing to evergreen and implement the Workplace Wellness and Culture Action Plan to support and sustain a healthy and resilient workplace and the physical and psychological health and safety of employees, including the prevention and resolution of harassment and discrimination.

- Concentrating on leadership development and learning through targeted support and resources, such as the implementation of FINTRAC’s Language School.

- Taking meaningful action to increase the diversity of the workforce, and foster a culture of inclusiveness and accessibility in line with existing initiatives and taking into account the vast work and guidance provided by the Call to Action on Anti-Racism, Equity, and Inclusion in the Federal Public Service and FINTRAC’s 2023–24 to 2025–26 Accessibility Plan.

- As one of the first public sector organizations to join Innovation, Science and Economic Development Canada’s 50 – 30 Challenge, FINTRAC will continue to prioritize initiatives and programs that improve access for employment equity and equity seeking groups to positions of influence and leadership on committees and in senior management, as well as to achieve diversity, inclusion and equality in the workplace. FINTRAC will continue to play an active member role in the Coalition of Innovation Leaders against Racism (CILAR) to support innovation leaders in the Black, Indigenous and Persons of Colour (BIPOC) community.

- FINTRAC will continue to evolve its Hybrid Work Model to provide staff with the opportunity to balance the innovation and collaboration opportunities that come from engaging with colleagues in the office with the flexibility and opportunity for greater focus when working from home. The coming year will present an opportunity to further define and shape the Centre’s working environment — one that values relationships, invigorates our collaborative spirit and re-energizes our focus on innovation and modernization through targeted investments in employee development, our physical space and technology.

- To effectively manage financials and generate efficiencies, FINTRAC will seek to modernize its Financial Management System (FMS) solution by leveraging technologies that can be easily integrated with other solutions and are interoperable with other Enterprise Resource Planning business processes, such as its new human capital management system solution. In 2023–24, FINTRAC, while playing a leadership role on behalf of similar-sized organizations, will continue to work closely with the Office of the Comptroller General to procure and start implementing a commercially-available Software-as-a-Service solution (SaaS) FMS solution. This new solution will also be a key element to support the administration of the cost recovery funding model.

- FINTRAC will continue the process of strengthening its Internal Control framework to support an effective system of internal control over financial management and financial reporting. This will ensure alignment with the Office of the Comptroller General’s new methodology for internal control risk assessments in small departments and agencies, and allow the Centre to identify and mitigate potential risks resulting from the new business processes to administer cost recovery.

- A key focus for 2023–24 will be the targeted investment projects identified in FINTRAC’s three-year Digital Strategy aimed at using new and emerging digital technologies to add business value, improve operational performance, enhance digital services, and explore new ways to deliver the Centre’s mandate. This fiscal year, the Centre will keep maturing its foundational digital capabilities, continually improve security, migrate critical assets through cloud transformation, update systems by taking advantage of more flexible and modern architecture in the cloud, continue to expand the use of Application Programming Interfaces, and advance the Centre’s disaster recovery capabilities.

- In addition, FINTRAC will advance the automation of its core business by implementing new agile, product-driven processes and adopting user-centred product delivery approaches for its operational functions of Intelligence, Compliance and Advanced Analytics. The Centre seeks to reduce the time and effort required to conduct Intelligence activities by continuing the modernization of its suite of intelligence products and making better use of all available data and knowledge assets.

Planning for Contracts Awarded to Indigenous Businesses

The Government of Canada, through collaboration with Public Services and Procurement Canada Indigenous Services Canada and the Treasury Board of Canada Secretariat, is implementing a mandatory requirement for federal departments and agencies to ensure that a minimum of 5% of the total value of contracts are held by Indigenous businesses. In 2023–24, FINTRAC will implement its plan to support the Procurement Strategy for Indigenous Businesses and meet its minimum target by fiscal year 2024–25. This plan will be focused on providing stakeholders with the tools and resources needed, coupled with proactive and effective communication and change management.

Planned budgetary spending for Internal Services

The following table shows, for internal services, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) |

2023–24 planned spending |

2024–25 planned spending |

2025–26 planned spending |

|---|---|---|---|

| $59,314,244 | $60,572,895 | $56,028,736 | $42,121,770 |

Planned human resources for Internal Services

The following table shows, in full time equivalents, the human resources the department will need to carry out its internal services for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents |

2024–25 planned full-time equivalents |

2025–26 planned full-time equivalents |

|---|---|---|

| 236 | 224 | 190Footnote 7 |

Planned spending and human resources

This section provides an overview of the department’s planned spending and human resources for the next three fiscal years and compares planned spending for 2023–24 with actual spending for the current year and the previous year.

Planned spending

Departmental spending 2020–21 to 2025–26

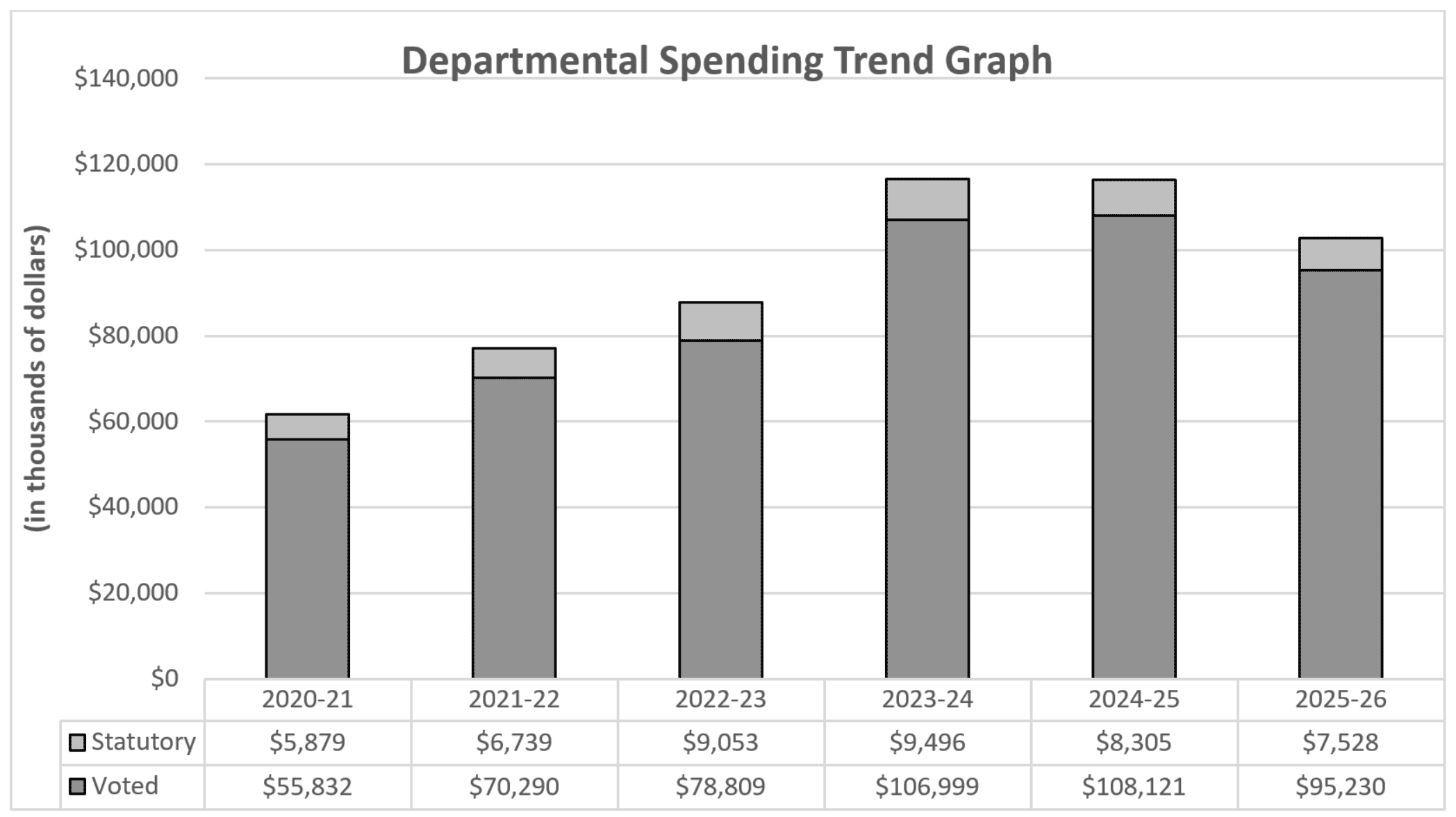

The following graph presents planned spending (voted and statutory expenditures) over time.

Actual Spending (2020–21 and 2021–22)

The resources available for spending in 2020–21 and 2021–22 were $80.3M and $90.3M respectively. Resources available for spending increased by $10M from 2020–21 to 2021–22 primarily due to the funding announced in Budget 2020 supporting program pressures, program modernization, and the planned relocation of FINTRAC's office space.

Actual spending was $61.7M in 2020–21 and $77.0M in 2021–22, an increase of $15.3M (25%). The increase in spending is primarily due to the following:

- Personnel expenditures, including statutory expenditures, increased by $8.2M following an increase in the number of full-time equivalents.

- Professional and special services increased by $4.9M in 2021–22. Expenses increased in various service categories including legal services, project management services, and other professional services.

- Rentals increased by $1.2M in 2021–22. Expenses increased with respect to the rental of office buildings and informatics equipment.

- Increases in spending for the acquisition of equipment, information, repair and maintenance, and telecommunications.

Forecasted Spending (2022–23)

Total authorities available for use in 2022–23 are anticipated to be $97.1M. This is an increase of $6.8M (7.5%) over the $90.3M in authorities available for use in 2021–22.

Forecast spending is anticipated to be $87.9M in 2022–23, consisting of $78.8M in voted authorities and $9.1M in statutory authorities. This is an increase of $10.9M (14%) compared to the actual spending of $77.0M in 2021–22. FINTRAC's expenditures increased from the prior year following the receipt of new funding to strengthen Canada's AML/ATF Regime, and funds received to develop virtual currency expertise, supervision of armoured car companies, and the implementation of a cost recovery funding model for FINTRAC's Compliance Program.

Planned Spending (2023–24 to 2025–26)

Planned spending is expected to increase from $87.9M in 2022–23 to $116.5M in 2023–24, an increase in projected expenditures of $28.6M (32%). The following year, expenditures are anticipated to decrease by $0.1 (-0.1%) to $116.4M in 2024–25. Subsequent spending is expected to decrease by $13.7M (-12%) for 2025–26. The variance in planned spending between 2023–24 and 2025–26 is largely based on the profile of funds approved to strengthen Canada's AML/ATF Regime, which will enable FINTRAC to modernize its tools and processes, build capacity in evolving threat areas, protect its intelligence and information, preserve is supervisory capacity and expand its operations. This variance is also attributable to the profile of funds approved to develop virtual currency expertise, supervision of armoured car companies, and the implementation of a cost recovery funding model for FINTRAC's Compliance Program.

The following table shows actual, forecast and planned spending for each of FINTRAC’s core responsibilities and to Internal Services for the years relevant to the current planning year. FINTRAC is currently undertaking an exercise to review its attribution of Internal Services and identify the full costs of its Compliance Program, which is anticipated to be cost recovered beginning April 1, 2024.

Budgetary planning summary for core responsibilities and Internal Services (dollars)

The following table shows information on spending for each of FINTRAC’s core responsibilities and for its internal services for 2023–24 and other relevant fiscal years.

| Core responsibilities and internal services | 2020–21 |

2021–22 |

2022–23 |

2023–24 budgetary spending (as indicated in Main Estimates) |

2023–24 |

2024–25 |

2025–26 |

|---|---|---|---|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | $19,944,414 | $25,359,149 | $28,587,875 | $29,671,676 | $30,819,567 | $32,130,619 | $32,309,829 |

| Production and Dissemination of Financial Intelligence | $17,373,038 | $20,558,417 | $20,078,233 | $24,152,373 | $25,102,235 | $28,266,275 | $28,326,978 |

| Subtotal | $37,317,451 | $45,917,566 | $48,666,108 | $53,824,049 | $55,921,802 | $60,396,894 | $60,636,807 |

| Internal Services | $24,393,503 | $31,110,709 | $39,195,738 | $59,314,244 | $60,572,895 | $56,028,736 | $42,121,770 |

| Total | $61,710,954 | $77,028,275 | $87,861,846 | $113,138,293 | $116,494,697 | $116,425,630 | $102,758,577 |

Planned human resources

The following table shows information on human resources, in full-time equivalents (FTEs), for each of FINTRAC’s core responsibilities and for its internal services for 2023–24 and the other relevant years.

| Core responsibilities and internal services | 2020–21 |

2021–22 |

2022–23 |

2023–24 |

2024–25 |

2025–26 |

|---|---|---|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | 138 | 173 | 179 | 179 | 152 | 152 |

| Production and Dissemination of Financial Intelligence | 111 | 131 | 147 | 154 | 154 | 143 |

| Subtotal | 249 | 304 | 326 | 333 | 306 | 295 |

| Internal Services | 141 | 179 | 230 | 236 | 224 | 190 |

| Total | 390 | 483 | 556 | 569 | 530 | 485 |

Between 2020–21 and 2021–22, FTEs increased from 390 to 483. In 2022–23, FTEs are forecast to increase to 556 due to new FTEs provided through the funding to strengthen Canada's anti-money laundering and anti-terrorist financing regime, which will enable FINTRAC to modernize its tools and processes, build capacity in evolving threat areas, protect its intelligence and information, preserve is supervisory capacity and expand its operations. This increase is also attributable to the additional funding provided to develop virtual currency expertise, supervision of armoured car companies, and the implementation of a cost recovery funding model for FINTRAC's Compliance Program. The funding profile from these initiatives, as well as the ending of temporary funding over the reporting period result in FTEs increasing to 569 in 2023–24, and subsequently decreasing to 530 in 2024–25 and 485 in 2025–26.

Estimates by vote

Information on FINTRAC’s organizational appropriations is available in the 2023–24 Main Estimates.

Future-oriented condensed statement of operations

The future oriented condensed statement of operations provides an overview of FINTRAC’s operations for 2022–23 to 2023–24.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on FINTRAC’s website.

| Financial information | 2022–23 forecast results | 2023–24 planned results | Difference (2023–24 planned results minus 2022–23 forecast results) |

|---|---|---|---|

| Total expenses | 90,507,860 | 119,699,943 | 29,192,083 |

| Total revenues | 0 | 0 | 0 |

| Net cost of operations before government funding and transfers | 90,507,860 | 119,699,943 | 29,192,083 |

Corporate information

Organizational profile

Appropriate minister: The Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance

Institutional Head: Sarah Paquet, Director and Chief Executive Officer

Ministerial portfolio: Finance

Enabling instrument(s): Proceeds of Crime (Money Laundering) and Terrorist Financing Act, S.C. 2000, c. 17. (PCMLTFA)

Year of incorporation / commencement: 2000

Raison d’être, mandate and role: who we are and what we do

Information on FINTRAC’s raison d’être, mandate and role is available on FINTRAC's website.

Information on FINTRAC’s mandate letter commitments is available in the Minister’s mandate letter.

Operating context

Information on the operating context is available on FINTRAC's website.

Reporting framework

FINTRAC’s approved departmental results framework and program inventory for 2023–24 are as follows:

Departmental Results Framework

Core Responsibility 1: Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

-

Departmental Result: Reporting entities are compliant with their anti-money laundering and anti-terrorist financing obligations and requirements

- Indicator: Percentage of assessed reporting entities not requiring enforcement action

- Indicator: Percentage of Financial Transaction Reports submitted to FINTRAC that meet validation rules as an indicator of quality

Core Responsibility 2: Production and Dissemination of Financial Intelligence

-

Departmental Result: FINTRAC’s tactical financial intelligence informs investigative actions

- Indicator: Percentage of feedback from disclosure recipients that indicate that FINTRAC’s financial intelligence disclosure was actionable

-

Departmental Result: FINTRAC’s strategic financial intelligence informs policy and decision making

- Indicator: Percentage of Regime partners utilizing FINTRAC products to inform activities

Program inventory

Program: Compliance Program

Program: Strategic Policy and Reviews

Program: Financial Intelligence Program

Program: Strategic Intelligence Research and Analytics

Supporting information on the program inventory

Supporting information on planned expenditures, human resources, and results related to FINTRAC’s program inventory is available on GC InfoBase.

Supplementary information tables

Federal tax expenditures

FINTRAC’s Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government¬ wide tax expenditures each year in the Report on Federal Tax Expenditures. This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis plus.

Organizational contact information

Mailing address

Financial Transactions and Reports Analysis Centre of Canada

234 Laurier Avenue West

Ottawa, Ontario K1P 1H7

Canada

Telephone: 1-866-346-8722 (toll free)

Fax: 613-943-7931

Email: guidelines-lignesdirectrices@fintrac-canafe.gc.ca

Website: https://fintrac-canafe.canada.ca/intro-eng

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A document that sets out a department’s priorities, programs, expected results and associated resource requirements, covering a three year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

- departmental result (résultat ministériel)

- A change that a department seeks to influence. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that consists of the department’s core responsibilities, departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

- full-time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person year charge against a departmental budget. Full time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- gender-based analysis plus (GBA Plus)(analyse comparative entre les sexes plus [ACS Plus])

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography, language, race, religion, and sexual orientation.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2023–24 Departmental Plan, government-wide priorities are the high-level themes outlining the Government’s agenda in the 2021 Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation and fighting for a secure, just, and equitable world.

- high impact innovation (innovation à impact élevé)

- High impact innovation varies per organizational context. In some cases, it could mean trying something significantly new or different from the status quo. In other cases, it might mean making incremental improvements that relate to a high-spending area or addressing problems faced by a significant number of Canadians or public servants.

- horizontal initiative (initiative horizontale)

- An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- planned spending (dépenses prévues)

- For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports. - program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- An inventory of a department’s programs that describes how resources are organized to carry out the department’s core responsibilities and achieve its planned results.

- result (résultat)

- An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization’s influence.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.

- Date Modified: