2022–23 Departmental Results Report

For the period ending March 31, 2023

The Honourable Chrystia Freeland P.C, M.P.

Deputy Prime Minister and Minister of Finance

ISSN 2560-8924

On this page

- From the Director and Chief Executive Officer

- Results at a glance

- Results: what we achieved

- Spending and human resources

- Corporate information

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: definitions

From the Director and Chief Executive Officer

I am pleased to share with Parliament and Canadians the real and impactful results delivered in 2022–23 by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Over the past year, FINTRAC played a key role in helping to protect the safety and security of Canadians, particularly Canada's most vulnerable citizens and communities. With the information that we receive from Canadian businesses, we were able to generate 2,085 unique financial intelligence disclosures in support of money laundering and terrorist financing investigations across Canada and around the world. This financial intelligence contributed to 292 major, resource intensive investigations last year, and many hundreds of other individual investigations at the municipal, provincial and federal levels across the country, and internationally. I was very pleased to see that 96% of the feedback that we received from law enforcement and national security agencies indicated that our financial intelligence was valuable and actionable.

We also helped to safeguard Canada's financial system and economy by assisting and ensuring the compliance of thousands of businesses with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and associated Regulations. In addition to responding to approximately 11,000 enquiries from entities across the country, we participated in nearly 200 engagement activities with businesses and their associations, including hosting a Banking Forum for representatives from industry and partner agencies. We also focused on developing modern new tools to help businesses better understand how they can meet their obligation to verify the identity of their clients.

At the same time, we continued to take a broad approach to ensuring the compliance of businesses, including monitoring transaction reporting, engaging in quarterly meetings with the Major Reporters, and establishing and following up regularly on compliance action plans. We also undertook 237 examinations, many of which were focused on complex entities that provide substantial reporting to FINTRAC, levied six administrative monetary penalties and provided 10 non-compliance disclosures to law enforcement.

We worked effectively throughout the year to strengthen our key partnerships in Canada and internationally. We collaborated with the Financial Consumer Agency of Canada and Scotiabank, under the umbrella of the global Finance Against Slavery and Trafficking (FAST) Survivor Inclusion Initiative, to provide new guidance to businesses, which is meant to facilitate access to banking services for the survivors of human trafficking whose financial identity or banking products may have been hijacked by their traffickers for money laundering or other criminal purposes.

Following the Russian Federation's illegal invasion of Ukraine, we worked with our closest allies, including the United States, Australia and the United Kingdom, to establish the Russia-Related Sanctions and Illicit Finance Financial Intelligence Units Working Group. Over the past year, members have worked within their respective authorities to surge the sharing of tactical financial intelligence and develop a common base of understanding through the dissemination of strategic-level intelligence on a variety of related issues.

We also launched a first-of-its-kind international public-private partnership targeting the money laundering associated with illegal wildlife trade. While endangering the global environment and countless species at risk, this heinous activity is also a major transnational organized crime, which generates approximately $20 billion (USD) in criminal proceeds each year. By following the money and generating actionable financial intelligence for law enforcement in Canada and around the world, this international public-private partnership, named Project Anton, will be critical in identifying, pursuing and prosecuting perpetrators – and broader networks – linked to illegal wildlife trade.

As we work to meet new and evolving challenges and risks in the money laundering and terrorist financing landscape, we made important progress in modernizing our approaches, programs and technologies over the past year. We continued to implement numerous legislative and regulatory changes, which are helping to strengthen Canada's Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) Regime. In preparation for the introduction of a cost recovery funding model for our Compliance Program, we also took a number of key steps aimed at ensuring our compliance activities are more targeted and agile in meeting the diverse needs, expectations and capacities of all business sectors. Underpinning our broader, FINTRAC-wide modernization efforts is our comprehensive Digital Strategy, which is transforming the Centre into a leading digital organization. Investing in our data and technological capabilities, modernizing our systems, and moving to the cloud are critical to our future success as Canada's modern Financial Intelligence Unit and AML/ATF Supervisor.

I want to recognize and thank our talented and dedicated employees for their hard work and the impressive results that are captured throughout this departmental results report. I am proud to work with such capable professionals who are recognized here in Canada and internationally for their knowledge, expertise and commitment to the global fight against money laundering and the financing of terrorism.

______________________

Sarah Paquet

Director and Chief Executive Officer

Results at a glance

| 2022–23 main estimates | 2022–23 planned spending | 2022–23 total authorities available for use | 2022–23 actual spending (authorities used) | 2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| $74,987,529 | $78,784,896 | $95,722,723 | $88,153,379 | $9,368,483 |

| 2022–23 planned full-time equivalents | 2022–23 actual full-time equivalents | 2022–23 difference (actual full-time equivalents minus planned full-time equivalents) |

|---|---|---|

| 468 | 526 | 58 |

FINTRAC's Strategic Plan 2019–24 outlines the Centre's vision and strategic priorities, built on a foundation of three pillars that, together, bring to life the vision of contributing to the safety of Canadians and the security of the economy, as a trusted leader in the global fight against money laundering and terrorist activity financing.

Inside the overarching pillars of 1) Promote a culture of accountability; 2) Prepare FINTRAC for the future; and 3) Collaborate to strengthen results, the Strategic Plan articulates six priorities that are summarized below, along with some of the key strategic actions that will enable the Centre to realize its vision.

For more information on FINTRAC's plans, priorities and results achieved, see the "Results: what we achieved" section of this report.

Pillar 1: Promote a culture of accountability

FINTRAC's objective is to have a resilient, agile workforce accountable for achieving the Centre's priorities within a culture that values diversity, collaboration, civility and ethical behaviour.

| FINTRAC priorities | 2022–23 results achieved |

|---|---|

| Maximize the potential of our people |

|

| Ensure transparency through results and performance |

|

Pillar 2: Prepare FINTRAC for the future

FINTRAC's objective is to maintain a work environment that supports innovation and provides the support and tools, especially information and data, to deepen the Centre's analysis and approaches.

| FINTRAC priorities | 2022–23 results achieved |

|---|---|

| Modernize the workplace |

|

| Explore and implement innovative solutions |

|

Pillar 3: Collaborate to strengthen results

FINTRAC's objective is to leverage the knowledge and expertise of our domestic and international partners to influence change in the way we detect and deter money laundering and terrorist activity financing.

| FINTRAC priorities | 2022–23 results achieved |

|---|---|

| Cultivate strategic relationships with key external stakeholders |

|

| Strengthen cross-government cooperation |

|

As a small agency, FINTRAC embraces the concept of 'experimentation' through its continued commitment to innovate and evolve its operational programs and internal services activities. Moving ahead to 2023–24, FINTRAC is committed to exploring new collaborations and work arrangements within Canada's AML/ATF Regime and through public and private partnerships with its major reporting entities in the continuing fight against money laundering and terrorist activity financing.

For more information on FINTRAC's plans, priorities and results achieved, see the "Results: what we achieved" section of this report.

Results: what we achieved

Core responsibilities

Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

Description

FINTRAC is responsible for ensuring compliance with Part 1 and Part 1.1 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its associated Regulations. This legal framework establishes obligations for reporting entities to develop and implement a compliance program in order to identify clients, monitor business relationships, keep records and report certain types of financial transactions. FINTRAC undertakes enabling and enforcement actions to ensure that the reporting entities operating within Canada's financial system fulfill their PCMLTFA obligations. These obligations provide important measures for countering patterns and behaviours observed in criminals and terrorists in order to deter them from operating within the legitimate channels of Canada's economy. FINTRAC also maintains a registry of money services businesses in Canada and foreign money services businesses that direct and provide services to persons and entities in Canada.

Results

As part of its core mandate, FINTRAC administers a comprehensive, risk-based compliance program to assist and ensure that thousands of businesses fulfill their obligations under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (the Act) and associated Regulations.

These obligations allow for certain economic activities to be more transparent, which helps deter criminals and terrorists from using Canada's financial system to launder the proceeds of their crimes or to finance terrorist activities.

Compliance with the legislation also ensures that FINTRAC receives the information that it needs to generate actionable financial intelligence for Canada's law enforcement and national security agencies.

As FINTRAC prepares for the introduction of a cost recovery funding model for its Compliance Program, which begins on April 1, 2024, the Centre has launched a multi-year modernization initiative called R.I.S.E. (Respond, Innovate, Simplify, Evolve) aimed at ensuring that its compliance activities are more targeted and agile in meeting the diverse needs and expectations of all business sectors. FINTRAC wants to make it easier for businesses to fulfil their legal obligations by providing meaningful support, refined processes, service and tools, among other efficiencies. The Centre is also focused on equipping its people with greater automation, digital tools and solutions to keep pace with the innovative technologies used by businesses.

FINTRAC took a number of concrete steps in 2022–23 as part of its R.I.S.E. initiative, including establishing a modernization team and conducting comprehensive research and engagement with businesses, associations and relevant stakeholders to seek their views on how to improve the reach, accessibility, responsiveness and impact of FINTRAC's Compliance Program. This research has supported foundational analysis, planning and development of the modernization agenda with key activities and service-oriented opportunities going forward. As part of the R.I.S.E initiative, FINTRAC has also implemented a number of technological building blocks to support modernization on a broad scale, including the creation of a new cloud-based controlled-access testing portal in order to streamline the adoption of system-to-system reporting.

In addition to advancing the broader R.I.S.E. initiative, FINTRAC's compliance program remained focused on its three pillars: assistance, assessment and enforcement.

Assistance to businesses

FINTRAC is committed to working with businesses across the country to assist them in understanding and complying with their obligations under the Act and associated Regulations.

In addition to publishing comprehensive and sector-specific guidance for businesses subject to the Act, FINTRAC provides timely and targeted guidance in relation to legislative and regulatory changes and other compliance-related issues on an ongoing basis.

In 2022–23, FINTRAC also developed and launched a new video series to help businesses better understand how to meet their obligation to verify the identity of their clients. This obligation removes the anonymity from financial transactions and is one of the most important measures in place to protect Canada's financial system from money launderers and terrorist financiers. The videos posted throughout the year (and more to come in 2023–24) capture, in a simple and succinct way, the different methods that businesses can use to verify the identity of a person or entity conducting a financial transaction. The videos are meant to increase the awareness and understanding of businesses of their obligation and support their anti-money laundering and anti-terrorist financing training needs. They have been viewed thousands of times to date and have been very well received by businesses.

In April 2022, crowdfunding platforms and certain payment service providers became subject to legal obligations under the Act as money services businesses. These obligations include registering with FINTRAC, developing and maintaining a compliance program, identifying clients, keeping certain records, including records related to transactions and client identification, and reporting certain financial transactions, including international electronic funds transfers and suspicious transactions. The Centre published comprehensive new guidance tailored to the businesses affected by this change to assist them in understanding and complying with the new obligations.

FINTRAC also engaged extensively with crowdfunding platforms, payment service providers and key stakeholders throughout the year to ensure the entities were aware of the new requirements. This included hosting numerous information sessions for implicated businesses, lawyers, consultants and financial entities; presenting information on FINTRAC and the requirements to Fintechs Canada, an association of Canadian financial technology companies primarily engaged in the payments space; and meeting with the National Payments Institute to clarify the Centre's position with respect to payroll services providers. FINTRAC also spoke regularly of the new requirements in relation to crowdfunding platforms and certain payment service providers at conferences across the country, including at the Association of Certified Anti-Money Laundering Specialists Conference in Toronto.

In 2022–23, FINTRAC undertook 193 outreach and engagement activities with businesses, industry associations, provincial regulators, federal departments and regulators, stakeholders and international partners through virtual and onsite meetings, presentations, conferences, fora, training, and other exchanges of information. The Centre also conducted consultations on a number of issues, including new and revised guidance, reporting forms and the implementation of regulatory amendments.

Maintaining regular and constructive dialogue with Canada's financial institutions is critical to the success of Canada's AML/ATF Regime given these organizations provide approximately 90% of the reporting that FINTRAC receives every year. Over the past year, the Centre undertook 81 proactive engagement activities with Canada's largest financial institutions and with small- and medium-sized banks on examinations, follow-up examinations and reports monitoring. This includes meeting with each large bank on a quarterly basis to monitor the ongoing state of their anti-money laundering and anti-terrorist financing program and what they are doing to identify and address risks to the financial system.

In February 2023, FINTRAC hosted a Banking Forum for Chief Anti-Money Laundering Officers, compliance officers and their delegates from across Canada's banking sector. In total, more than 100 attendees gathered in person and over 250 people joined virtually from all Canadian banks, five other federal agencies, the Canadian Bankers Association and other stakeholder organizations. The theme for the forum was "Future Forward: Risk-Based Frameworks for a Digital Age" and included discussions on FINTRAC's Compliance Modernization, the anticipated Parliamentary Review of the Act, FINTRAC's modern approach to assessing and enforcing compliance, and the promise of artificial intelligence in RegTech.

Over the past year, FINTRAC also continued to strengthen its engagement in the real estate sector across the country. Beginning in October 2022, the Centre established monthly touch points with the Canadian Real Estate Association to discuss regulatory expectations, high-level examination trends and explore new ways of working together to strengthen anti-money laundering and anti-terrorist financing compliance in the sector. FINTRAC has also collaborated, on a regular basis, with the British Columbia Real Estate Association, participating in webinars in relation to compliance obligations and addressing questions from the sector on administrative monetary penalties in British Columbia. In addition, FINTRAC is assisting the association in the creation of a training module in relation to identifying suspicious transactions and reporting them to the Centre.

As well, over the past year, FINTRAC provided a number of presentations and participated in numerous symposia and webinars focused on enhancing understanding and compliance with the obligations under the Act and Regulations, including in association with the Canadian Life and Health Insurance Association, the Canadian Jewelers Association and the Canadian Credit Union Association.

In 2022–23, FINTRAC provided 302 policy interpretations to clarify its approach to the application of the Act. Common interpretations were related to regulatory changes, verifying identity, reporting international electronic funds transfers, and determining whether a business was considered a reporting entity under the Act. FINTRAC's policy interpretations, many of which involve complex business models, are generally posted on its website without identifying information, to assist other businesses that may have similar questions.

Throughout 2022–23, FINTRAC responded to 10,978 enquiries from businesses in every reporting sector on a broad range of issues, including reporting obligations, access to reporting systems, the registration of money services businesses, and the requirements associated with the regulatory amendments which came into force in June 2021.

Businesses that exchange foreign currencies, transfer money, cash/sell money orders or traveller's cheques, or deal in virtual currency must register with FINTRAC before offering these services to the public. Moreover, they must renew their registration every two years. A registration with FINTRAC does not indicate an endorsement or licensing of the business. It only means that the business has fulfilled its legal requirement under the Act to register with FINTRAC.

Individuals convicted of certain offences under, among other statutes, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, the Controlled Drugs and Substances Act or the Criminal Code are ineligible to register a money services business in Canada. Should such a determination be made, the registration is either denied or revoked. Money services businesses are also required to respond to demands for information from FINTRAC or their registrations are revoked. In total, there were 81 revocations in 2022–23. To enhance transparency and assist other business sectors with their risk assessments, FINTRAC publishes, on a quarterly basis, the names of money services businesses whose registration has been revoked.

FINTRAC also undertakes a validation initiative every year to confirm the existence of specific money services businesses and determine where entities may potentially be operating without being registered (in other words, illegally) with the Centre. In 2022–23, FINTRAC conducted 188 validations on money services businesses in Canada that were suspected of being unregistered. This resulted in 20 new entities registering with FINTRAC.

In total last year, 1,201 money services businesses registered or were renewed with FINTRAC. In addition, 219 businesses ceased their registrations and 296 registrations expired. As of March 31, 2023, 2,489 money services businesses were registered with the Centre.

Assessment

FINTRAC monitors the quality, timeliness and volume of the financial transaction reporting that it receives from businesses across the country. The Centre has invested heavily in validating and monitoring reporting data, including improving its business processes to increase the effectiveness of its monitoring. In 2022–23, FINTRAC received a total of 36,286,939 financial transaction reports from businesses. The Centre rejected 73,878 reports for not meeting quality requirements. It accepted 456,068 financial transaction reports for which it subsequently issued a warning to businesses about the quality of those reports.

When issues relating to reporting data quality, timing or volume are identified, FINTRAC addresses them through engagement, an examination or another compliance activity. Through this type of data monitoring, the Centre is also able to identify over-reporting and follow up with businesses to remove or delete from their database those reports that should not have been received.

Examinations are one of FINTRAC's primary instrument for assessing the compliance of businesses subject to the Act. The Centre uses a risk-based approach to select the businesses that will be examined every year, focusing a significant portion of its examination resources on businesses that report large numbers of transactions or are at a higher risk of being deficient or exploited by money launderers or terrorist financiers. Consistent with its transition from an audit to an assessment approach over the past few years, FINTRAC has undertaken more complex, lengthy and in-depth examinations of larger businesses in higher-risk sectors to determine how effectively they are fulfilling their compliance obligations.

Largest number of examinations by sector (Top three)

- 2022–23

- MSBs (86)Footnote *

- Real estate (71)

- Securities dealers (38)

- 2021–22

- Real estate (96)

- MSBs (89)Footnote *

- Securities dealers (34)

- 2020–21

- Real estate (53)

- MSBs (50)Footnote *

- Securities dealers (25)

FINTRAC has also modernized and enhanced its engagement with businesses and its risk-based approach to ensuring compliance with the Act and Regulations. Recognizing that different business sectors have varying levels of knowledge of their obligations and differing needs, examinations were conducted in ways that increase awareness and understanding of the requirements under the Act and the role businesses play in combatting money laundering and terrorist activity financing; improve compliance with the Act; strengthen the identification and monitoring of high risk clients; and enhance reporting to FINTRAC.

In 2022–23, 95% of businesses assessed by FINTRAC did not require enforcement action. This means that these assessments resulted in no further activity or in a follow-up activity (for example, data integrity monitoring, a follow-up assessment, an action plan, etc.).

FINTRAC regularly reminds businesses of its Voluntary Self-declaration of Non-compliance, a mechanism for informing the Centre when businesses face instances of non-compliance. Promoting open dialogue and transparency without the threat of a penalty, such notices allow the Centre to work collaboratively with businesses in addressing non-compliance that they have identified. In particular, this mechanism helps to ensure that FINTRAC receives reporting that it otherwise might not have, information that is critical to the production of actionable financial intelligence for Canada's police, law enforcement and national security agencies.

In 2022–23, FINTRAC received 281 Voluntary Self-declaration of Non-compliance notices. Financial institutions submitted the majority of these declarations, pertaining to reports that had not been provided. The Centre collaborated with these financial institutions to ensure that the transactions reporting were submitted accurately to FINTRAC, and provided guidance where required.

Follow-up examinations are an assessment tool that FINTRAC leverages, when appropriate, to determine if a business has addressed previous instances of non-compliance. In 2022–23, the Centre conducted 40 follow-up examinations. Of these, no further activity was required in 18 cases as the businesses demonstrated a positive change in their compliance behaviour. The remaining 22 examinations resulted in an enforcement action or a recommendation for additional follow-up activity.

Enforcement

FINTRAC is committed to working with businesses to assist them in understanding and complying with their obligations. However, the Centre is also prepared to take firm action when it is required to ensure that businesses take their responsibilities seriously.

In 2008, FINTRAC received the legislative authority to issue administrative monetary penalties to businesses that are in non-compliance with the Act. Under the legislation, penalties are intended to be non-punitive and are focused on changing the non-compliant behaviour of businesses. The administrative monetary penalties program supports FINTRAC's mandate by providing a measured and proportionate response to particular instances of non-compliance.

In 2019, the Centre published its updated Administrative Monetary Penalties policy, which outlines clearly and transparently the penalty process and FINTRAC's method of calculating penalties for non-compliance with the Act and associated Regulations. The Centre also developed and published a number of specific guides that describe its approach to assessing the harm done by the 200 violations prescribed in the Proceeds of Crime (Money Laundering) and Terrorist Financing Administrative Monetary Penalties Regulations, as well as FINTRAC's rationale in determining the corresponding penalty amounts.

As of 2019, FINTRAC is required to publicly name all persons and entities that receive an administrative monetary penalty. However, the public notice of the penalty may occur months after the issuance of a Notice of Violation. Therefore, the fiscal year that an administrative monetary penalty is made public may not align with the fiscal year that the Notice of Violation is issued.

In 2022–23, FINTRAC issued six Notices of Violation of non-compliance for a total of $1,113,569. Four Notices of Violation were issued in the MSB sector for a total of $156,255. One was issued in the financial entity sector for $858,000 and one in the dealers of precious metals and precious stones sector for $99,314.

FINTRAC has issued 128 Notices of Violation across most business sectors since it received the legislative authority to do so in 2008.

Under the Act, FINTRAC may disclose cases of non-compliance to law enforcement when it is extensive or if there is little expectation of immediate or future compliance. In 2022–23, the Centre disclosed 10 such cases.

Innovation

To effectively and efficiently deliver the outcomes identified in the FINTRAC Digital Strategy and progress further through automation of the Centre's Core Business and Digital Office, FINTRAC is embracing Product Management. In 2022–23, FINTRAC began piloting a Product Management approach within one product family and has established the foundation for expansion to additional business activities. As a next step, FINTRAC will begin evaluating its level of success in delivering a complete agile lifecycle management of the Centre's products and services, with the goal of building business value, reducing pain points for Canadian businesses who are required to report under our legislation and addressing the needs of specific target segments.

FINTRAC's implementation of a product management approach is currently supporting the agile development of new business tools, with the objective of ensuring delivery of value and benefits through iterative prototyping, helping define FINTRAC's product development roadmap and achieve faster delivery of enterprise capabilities.

Results achieved

The following table shows, for Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations, the results achieved, the performance indicators, the targets and the target dates for 2022–23, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2020–21 actual results |

2021–22 actual results |

2022–23 actual results |

|---|---|---|---|---|---|---|

| Reporting entities are compliant with Anti-Money Laundering and Anti-Terrorist Financing obligations and requirements | Percentage of assessed reporting entities not requiring enforcement actionFootnote 1 | 90% | March 31, 2023 | 94% | 94% | 95% |

| Percentage of financial transaction reports submitted to FINTRAC that meet validation rules as an indicator of quality | 90% | March 31, 2023 | 88% | 87% | 90% |

Financial, human resources and performance information for FINTRAC's program inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations, budgetary spending for 2022–23, as well as actual spending for that year.

| 2022–23 main estimates |

2022–23 planned spending |

2022–23 total authorities available for use |

2022–23 actual spending (authorities used) |

2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| $23,907,929 | $25,206,629 | $30,946,697 | $27,692,974 | $2,486,345 |

Financial, human resources and performance information for FINTRAC's program inventory is available in GC InfoBase.

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to fulfill this core responsibility for 2022–23.

| 2022–23 planned full-time equivalents |

2022–23 actual full-time equivalents |

2022–23 difference (actual full time equivalents minus planned full time equivalents) |

|---|---|---|

| 146 | 180 | 34 |

Financial, human resources and performance information for FINTAC's program inventory is available in GC InfoBase.

Production and dissemination of financial intelligence

Description

FINTRAC is mandated by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) to produce actionable financial intelligence that assists Canada's police, law enforcement, national security and other international and domestic partner agencies in combatting money laundering, terrorism financing and threats to the security of Canada, while protecting the personal information entrusted to FINTRAC. The Centre also produces strategic financial intelligence for federal policy and decision-makers, the security and intelligence community, reporting entities across the country, international partners and other stakeholders. FINTRAC's strategic intelligence provides a wide analytical perspective on the nature, scope and threat posed by money laundering and terrorism financing.

Results

Given the complexity of connecting the flow of illicit funds often involving organized criminal groups, FINTRAC's financial intelligence very often contains hundreds or even thousands of financial transaction reports in each disclosure. A financial intelligence disclosure may show links between individuals and businesses that have not been identified in an investigation, and may help investigators refine the scope of their cases or shift their sights to different targets. A disclosure can pertain to an individual or a wider criminal network, and can be used by law enforcement to put together affidavits to obtain search warrants and production orders. FINTRAC's financial intelligence is also used to reinforce applications for the listing of terrorist entities, negotiate agreements at the time of sentencing and advance the Government's knowledge of the financial dimensions of threats, including organized crime and terrorism.

| 2022–23 | 2,085 |

| 2021–22 | 2,292 |

| 2020–21 | 2,046 |

| 2019–20 | 2,057 |

| 2018–19 | 2,276 |

During the year, the Centre generated 2,085 unique financial intelligence disclosures in support of money laundering and terrorist activity financing investigations across Canada and around the world. More than 26% (554 of 2,085) of the Centre's financial intelligence disclosures last year were provided proactively to Canada's law enforcement and national security agencies, which means the individuals or networks identified in the financial intelligence may not have been known to these agencies before FINTRAC's intelligence was received.

| Drugs | 31% |

| Fraud | 25% |

| Crimes against persons | 13% |

| Human smuggling/ trafficking | 12% |

| Tax evasion | 11% |

In 2022–23, FINTRAC's financial intelligence was used in a wide variety of money laundering investigations where the origins of the suspected criminal proceeds were linked to drug trafficking, fraud, crimes against persons, human smuggling/trafficking, tax evasion, and other criminal offences.

Throughout 2022–23, the Centre's financial intelligence contributed to 292 major, resource intensive investigations as well as many hundreds of other individual investigations at the municipal, provincial and federal levels across the country. Canadian law enforcement agencies—particularly the Royal Canadian Mounted Police—continue to be the main recipients of FINTRAC's financial intelligence.

| Royal Canadian Mounted Police | 2,352 |

| Municipal police | 1,050 |

| Provincial police | 670 |

| Canada Border Services Agency | 586 |

| Canadian Security Intelligence Service | 239 |

| Foreign Financial Intelligence Units | 225 |

| Canada Revenue Agency | 205 |

| Provincial Securities Regulators | 41 |

| Revenu Québec | 24 |

| Communications Security Establishment | 8 |

| Department of National Defence | 5 |

| Competition Bureau | 2 |

FINTRAC's financial intelligence disclosures are often provided to a number of agencies simultaneously when there is authorization to do so. The ability to provide multiple disclosure packages means that the Centre can help law enforcement and national security agencies connect criminal activities and operations across a number of domestic and international jurisdictions by following the money.

FINTRAC always seeks feedback on its financial intelligence from disclosure recipients at the municipal, provincial and federal levels. Over the past year, the Centre received 190 disclosure feedback forms, 96% percent of which indicated that FINTRAC's financial intelligence was actionable. This is a clear and significant measure of the effectiveness of, and results achieved by, FINTRAC under the Act.

Results through public-private partnerships

FINTRAC's financial intelligence supports results across Canada's AML/ATF Regime and has been at the forefront of significant innovation. With Canadian businesses and law enforcement agencies throughout Canada, the Regime has put in place a number of very successful public-private partnerships, aimed at more effectively combatting the laundering of proceeds stemming from human trafficking for sexual exploitation, online child sexual exploitation, romance fraud, the trafficking of illicit fentanyl, and money laundering in British Columbia and across Canada. Two more public-private partnerships were launched this year, to stem the laundering of proceeds from illicit cannabis and illegal wildlife trade, respectively.

A detailed overview of the important results achieved through Projects Protect, Guardian, Chameleon, Athena, Shadow, Legion and Anton can be found in FINTRAC's Annual Report. In total, in 2022–23, FINTRAC was able to provide 569 disclosures of actionable financial intelligence to Canada's law enforcement agencies in relation to the seven public-private sector partnerships.

Strategic intelligence

With the information that FINTRAC receives from its regime partners and businesses across the country, the Centre uses research and analytical techniques to identify emerging characteristics, trends and developments about the tactics used by criminals to launder money or fund terrorist activities. This work covered such threats as terrorist activity financing, Russia-linked money laundering activities related to sanctions evasion, professional money laundering, money laundering undertaken by domestic and international organized crime, laundering the proceeds of sexual exploitation, and issues related to economic and institutional integrity. Building on funding received in Budget 2021 and Budget 2022 that work also included deepening FINTRAC's expertise and understanding of risks and vulnerabilities associated with virtual currencies.

FINTRAC's strategic intelligence and research informs the Centre, the Department of Finance Canada (the lead of Canada's AML/ATF Regime), our other Regime partners, the security and intelligence community, Parliamentarians, reporting entities and the public about priority threats, risks and vulnerabilities. For example, in December 2022, FINTRAC published an Operational Alert providing a series of terrorist activity financing indicators (in other words, red flags) to further assist reporting entities in recognizing and reporting related suspicious financial transactions to the Centre. Terrorists use techniques like those of money launderers (for example, structuring, use of nominees) to evade authorities' detection and to protect the identities of their sponsors as well as the ultimate beneficiaries of the funds. Like money laundering, funds for terrorist activity financing can be sourced from criminal sources (for example, drug trade, smuggling of weapons and other goods, fraud, kidnapping and extortion). However, unlike money laundering, terrorist activity financing can be raised from legitimate sources too (for example, personal donations and profits from businesses and charitable organizations), making the detection and tracking of these funds more difficult. Funds for terrorist activity financing also tend to be in smaller amounts compared to funds in money laundering.

Efforts to avoid traditional financial channels were the dominant emerging theme of 2022–23, as money launderers and those financing terrorism sought to avoid detection or evade measures meant to restrict the flow of illicit and threat finance. While the traditional financial sector—albeit cloaked in complex methods of misdirection—remains the preferred channel for the flows of transnational proceeds of crime such as Russia-linked professional money launderers, there was continued broad-based adoption of small-scale terrorist financing and money laundering methods that focused on alternative methods.

Perhaps the most significant development in the context of illicit financial flows has been the introduction of international sanctions against Russia following its illegal and unprovoked invasion of Ukraine. This has prompted increased scrutiny of Russia-linked financial flows. Russian entities and individuals moving criminal proceeds rely on established professional money laundering networks and techniques to transfer funds from Russia to other jurisdictions. Such methods include the use of shell and front companies, offshore financial centres and secrecy jurisdictions known to cater to money laundering networks. Russian nationals will continue to obscure the source and beneficial ownership of assets through the use of proxies, including family members, and will adapt to international sanctions by further utilizing alternative financial channels, such as cryptocurrency and other emerging financial technologies.

The use of unregistered MSBs by international actors seeking to evade sanctions or engage in other types of illicit activity, such as terrorist or threat financing, will continue to present challenges for those seeking to detect them. Since the May 2022 publication of its Sectoral and Geographic Advisory on Underground Banking through Unregistered Money Services Businesses, FINTRAC has seen an increase in reporting on money laundering associated with underground banking, as well as identification of individuals and entities suspected to be operating unregistered MSBs. Suspicious transactions reported to FINTRAC have highlighted the significant role of third party intermediaries, such as professional money launderers and money mules, in facilitating underground banking and the laundering of criminal proceeds. Underground banking through unregistered MSBs will continue to be leveraged by international actors seeking to evade sanctions or engage in other types of illicit activity, such as terrorist or threat financing.

Despite the decline in prices for virtual assets, FINTRAC expects to see further long-term growth in the adoption of cryptocurrency by illicit and threat actors seeking to raise, move and hide funds outside the traditional banking system. Laundering the proceeds of fraud and ransomware attacks will continue to be the most prevalent form of money laundering involving virtual currencies. Despite massive growth in the number of identified cryptocurrency-related fraud schemes, the ways in which criminals defraud their victims and launder the proceeds of fraud are likely to remain consistent. Similarly, ransomware will remain a threat to Canadians and their livelihoods in the years to come due in part to the growing availability of malware linked to the Ransomware-as-a-service (RaaS) model, which makes advanced ransomware available to less sophisticated actors via darkweb marketplaces.

International awareness of crowdfunding techniques, whereby funds are sourced from a wide network of individuals to finance terrorist activity, has increased in recent years. Crowdfunding activities leverage social media and sometimes dedicated crowdfunding platforms—websites or applications that are used to raise funds or virtual currency through donations—to collect funds from a wide audience. Small donations, subscriptions, or payments provide an important financing base for a variety of activities undertaken by individual threat actors and groups.

The extension of Canada's AML/ATF Regime to capture crowdfunding platform services and certain payment service providers within its money services business (MSB) framework is likely to help in the detection, prevention, and deterrence of money laundering and terrorist financing. FINTRAC expects terrorist entities to continue to shift towards alternative fiat crowdfunding platforms online as a result of increased vigilance by mainstream platforms. Other groups are likely to increase the sophistication of their crowdfunding efforts by leveraging new technologies, such as cryptocurrency.

Innovation

To effectively and efficiently deliver the outcomes identified in the FINTRAC Digital Strategy and progress further through automation of the Centre's Core Business and Digital Office, FINTRAC is advancing targeted investment projects to enrich the toolkit available to enhance the quality of financial intelligence output. Two key aspects of these projects are the use of synthetic data and the establishment of a vendor portal. In 2022–23, FINTRAC began implementation of a cloud-based secure vendor portal environment, an environment that will provide the Centre with the ability to better assess the performance, outputs and value of new capabilities. In addition, FINTRAC has successfully generated large volumes of synthetic data. Together, these new elements will allow FINTRAC to invite vendors into the portal using agile procurement processes for an opportunity to demonstrate how they may be able to respond to FINTRAC's business needs using data that is representational of the Centre's actual data. The approach will strengthen FINTRAC's ability to assess vendor capabilities and allow for the adoption of modular solutions that will better integrate with FINTRAC's analytical system, reduce risk of failure, and achieve faster delivery of enterprise capabilities.

Results achieved

The following table shows, for Production and Dissemination of Financial Intelligence, the results achieved, the performance indicators, the targets and the target dates for 2022–23, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2020–21 actual results |

2021–22 actual results |

2022–23 actual results |

|---|---|---|---|---|---|---|

| FINTRAC's tactical financial intelligence disclosures inform investigative actions | Percentage of feedback from disclosure recipients that indicates that FINTRAC's financial intelligence disclosure was actionable | 85% | March 31, 2023 | 96% | 97% | 96% |

| FINTRAC's strategic financial intelligence informs policy and decision-making | Percentage of Regime partners using FINTRAC products to inform activitiesFootnote 2 | 70% | March 31, 2023 | 70% | 72% | 75% |

Financial, human resources and performance information for FINTRAC's program inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for Production and Dissemination of Financial Intelligence, budgetary spending for 2022–23, as well as actual spending for that year.

| 2022–23 main estimates |

2022–23 planned spending |

2022–23 total authorities available for use |

2022–23 actual spending (authorities used) |

2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| $19,587,477 | $20,662,132 | $21,564,986 | $22,877,752 | $2,215,620 |

Financial, human resources and performance information for FINTRAC's program inventory is available in GC InfoBase.

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to fulfill this core responsibility for 2022–23.

| 2022–23 planned full-time equivalents |

2022–23 actual full-time equivalents |

2022–23 difference (actual full-time equivalents minus planned full-time equivalents) |

|---|---|---|

| 133 | 137 | 4 |

Financial, human resources and performance information for FINTAC's program inventory is available in GC InfoBase.

Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are: Acquisition Management Services; Communication Services; Financial Management Services; Human Resources Management Services; Information Management Services; Information Technology Services; Legal Services; Material Management Services; Management and Oversight Services; and Real Property Management Services.

Results

Internal Services

As FINTRAC's responsibilities and operations continue to grow in scope and complexity, its ability to deliver on its mandate is tied directly to its adaptability, the skills and dedication of its employees, and the tools and resources that it provides them to do their work. As an organization committed to excellence, the Centre is focused on the effective management of its human, technological and financial resources.

The hybrid workplace and protecting the health and safety of employees

In early 2022–23, using its successful hybrid Flexible by Design model to analyze the telework potential of positions and to bridge the gap to a return to in-office workplaces when appropriate, FINTRAC completed analysis to develop a set of tools, guidelines and information sessions to ensure that all staff had a full understanding of the Centre's hybrid framework and its flexibility to respond to individual needs.

Over the summer of 2022, to encourage employees to take ownership of their own hybrid journey and to ensure organizational effectiveness, employees and leaders were encouraged to experiment with the new hybrid model and to discuss what additional protocols and processes would be needed based on each team's dynamics and operational needs. By September 2022, employees began returning to the office on a more consistent basis.

Ahead of this return and to support the spirit of collaboration among colleagues, FINTRAC modified workspaces and implemented the concept of neighbourhoods. The Centre also introduced a mechanism to monitor onsite presence against defined hybrid parameters to support management decisions where needed.

As a result, when the Government of Canada introduced its Common Hybrid Work Model in early 2023, FINTRAC was well positioned to quickly move, as an early adopter of this model, to assist employees in adapting to the new parameters of 40% to 60% monthly onsite presence. This adaptation was done well in advance of the Government of Canada timelines.

Throughout this period, the Centre maintained its focus on supporting staff mental health and well-being, with both FINTRAC's Ombuds and Champion for Mental Health actively engaged in assisting, supporting and listening to individual employees at every level and promoting, more broadly, information and advice to help staff manage personal and professional challenges, as well as the changing work environment. FINTRAC houses an Ombuds Office as part of its commitment to a respectful workplace. Created in May 2019 and reporting to the Director and CEO of FINTRAC, the Ombuds provides safe, respectful and judgement-free support to all staff and, when needed, guide parties to resolve problems as quickly and as informally as possible.

Inclusive, safe and healthy workplace

As part of its efforts to ensure a workplace that is inclusive, safe and healthy, FINTRAC is committed to supporting diversity, employment equity, official languages and multiculturalism. The Centre promotes these through its job posters, selection processes, job fairs and open houses. FINTRAC also continues to raise awareness through the related activities of its employee working groups and mark important moments of remembrance and celebration throughout the year.

This year, FINTRAC began implementing its new 2022–26 Employment Equity, Diversity and Inclusion (EEDI) Strategy and action plan. The Strategy highlights commitments in four priority areas: talent acquisition and retention, professional growth, leadership and accountability, and employee engagement.

In addition, to ensure everyone has the opportunity to build a sense of belonging and trust, regardless of race, ethnicity, sex, age, disability, sexual orientation or gender expression, the Centre took numerous actions this year to move the EEDI dial forward. These included: active communication to build awareness through drop-in coffee chats with members of the EEDI Working Group; holding an Indigenous History Month panel discussion; promoting various activities on multiculturalism and on religious minority groups; and holding a pride season 'design a banner contest', a quiz about LGBTQ+ facts and an event on gender and sexuality.

In keeping with its EEDI commitments, the Centre adopted and implemented the Executive Cadre Pledge on Diversity and Inclusion, which is a commitment by members of the executive cadre to address issues of racism and discrimination and to create inclusive workplaces both within the organization and across the Government of Canada.

In 2022–23, the Centre revamped its website career section to bolster such initiatives as 50-30 Challenge to increase the representation and inclusion of diverse groups within our workforce and to highlight the benefits of giving all Canadians a seat at the table. FINTRAC also maintained active partnerships with the Coalition of Innovation Leaders Against Racism, the Knowledge Circle for Indigenous Inclusion, and the Federal Youth Network.

This year, FINTRAC EEDI innovations and best practices were recognized by Canadian Heritage, which indicated the intent to highlight the Centre in its next Multiculturalism Report.

In 2022–23, FINTRAC continued to promote and support bilingualism in collaboration with the Official Language Champion and FINTRAC's Official Languages Working Group. Through employee engagement and awareness initiatives, the aim is to foster a culture and work environment where employees feel free to communicate in the official language of their choice. This year, numerous Centre-wide events and activities took place to celebrate official languages. These included a celebration of the Journée de la Francophonie, the distribution of the second and third editions of the Official Languages Newsletter, and the publication of regular messages and updates via FINTRAC's Official Languages Portal and Champion's page, which include various tips, tricks and other resources to promote bilingualism in the workplace.

During the year, FINTRAC also inaugurated its own Official Language School, with the objective to provide multiple opportunities and formats for employees to access standardized high quality in-person or virtual language training that meets the needs of learners working in a secured environment. In addition, employees from across the Centre's Ottawa, Montreal, Toronto and Vancouver sites continue to be able to take part in the Centre's Language Buddy System, which allows staff to practice and improve their second language skills with the help of a volunteer coach in a more informal setting.

Protecting personal information

In fulfilling its core financial intelligence and supervisory mandates, FINTRAC is committed to safeguarding the information that it receives and discloses to Canada's police, law enforcement and national security agencies. The Proceeds of Crime (Money Laundering) and Terrorist Financing Act strikes a careful balance between the Centre's receipt and disclosure of personal information to support essential criminal and national security investigations and the rights of Canadians to be protected from unnecessary invasions of their privacy.

The safeguarding of personal information is critical to FINTRAC and clear principles for the protection of privacy are set out in its governing legislation, including strict limitations on the information that can be received and disclosed, clear requirements for maintaining and disposing of records, and a biennial audit of FINTRAC's protection of information by the Office of the Privacy Commissioner. These principles are reinforced by the Centre's own operational policies and security measures.

FINTRAC is the only federal agency whose governing legislation requires a biennial audit by the Office of the Privacy Commissioner on the measures it takes to safeguard the personal information that it receives and collects under the Act. The Office of the Privacy Commissioner finalized its fourth review of FINTRAC's privacy protection measures in 2021–22. The Centre accepted the Privacy Commissioner's final audit report and focused on implementing the recommendations over the past year.

As part of its Special Report to Parliament, Protecting Privacy in a Pandemic, and following substantial engagement with FINTRAC officials, the Privacy Commissioner of Canada determined that FINTRAC's information exchanges and its handling of personal information related to the Emergency Economic Measures Order were appropriate and respected the authorities set out in the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

The protection of privacy is a clear priority and a critical result of FINTRAC's work. While helping to protect the safety of Canadians and security of Canada's economy, the Centre is determined to meet all of its obligations under the Privacy Act and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

Contracts awarded to Indigenous businesses

The Government of Canada is committed to reconciliation with Indigenous peoples and to improving socio‑economic outcomes by increasing opportunities for First Nations, Inuit and Métis businesses through the federal procurement process.

Under the Directive on the Management of Procurement , which came into effect on May 13, 2021, departments must ensure that a minimum of 5% of the total value of the contracts they award are held by Indigenous businesses. This requirement is being phased in over three years, and full implementation is expected by 2024.

Indigenous Services Canada has set the implementation schedule:

- Phase 1 departments: April 1, 2022, to March 31, 2023

- Phase 2 departments: April 1, 2023, to March 31, 2024

- Phase 3 departments: April 1, 2024, to March 31, 2025

FINTRAC is a Phase 3 organization and is aiming to achieve the minimum 5% target by the end of 2024–25.

In 2023–24, FINTRAC will implement its plan to support the Procurement Strategy for Indigenous Businesses and meet its minimum target by fiscal year 2024–25. This plan will focus on providing stakeholders with the tools and resources needed, coupled with proactive and effective communication and change management.

Budgetary financial resources (dollars)

The following table shows, for internal services, budgetary spending for 2022–23, as well as spending for that year.

| 2022–23 main estimates |

2022–23 planned spending |

2022–23 total authorities available for use |

2022–23 actual spending (authorities used) |

2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| $31,492,123 | $32,916,135 | $43,211,040 | $37,582,653 | $4,666,518 |

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to carry out its internal services for 2022–23.

| 2022–23 planned full-time equivalents |

2022–23 actual full-time equivalents |

2022–23 difference (actual full-time equivalents minus planned full-time equivalents) |

|---|---|---|

| 189 | 209 | 20 |

Spending and human resources

Spending

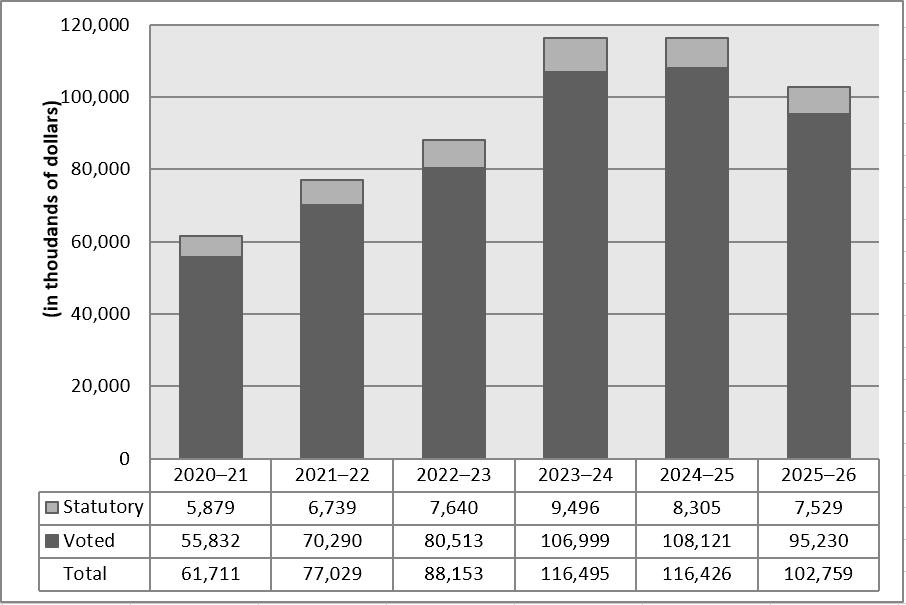

Spending 2020–21 to 2025–26

The following graph presents planned (voted and statutory spending) over time.

View the text equivalent for Departmental Spending Trend

| Fiscal year | Statutory | Voted | Total |

|---|---|---|---|

| 2020–21 | $5,879 | $55,832 | $61,711 |

| 2021–22 | $6,739 | $70,290 | $77,029 |

| 2022–23 | $7,640 | $80,513 | $88,153 |

| 2023–24 | $9,496 | $106,999 | $116,495 |

| 2024–25 | $8,305 | $108,121 | $116,426 |

| 2025–26 | $7,529 | $95,230 | $102,759 |

Actual spending was $61.7M in 2020–21 and $77.0M in 2021–22, an increase of $15.3M (25%). Total expenditures in 2022–23 were $88.2M, an increase of $11.2M (14.5%) compared to spending of $77.0M in 2021–22. FINTRAC's expenditures increased from prior years following the receipt of new funding announced in Budget 2022 to strengthen Canada's AML/ATF Regime, and the receipt of new funding announced in Budget 2021 to develop virtual currency expertise, supervision of armoured car companies, and the implementation of a cost recovery-funding model for FINTRAC's Compliance Program.

Planned spending is expected to increase from $88.2M in 2022–23 to $116.5M in 2023–24 and $116.4M in 2024–25. Subsequent spending is expected to decrease to $102.8M in 2025–26. The variance in planned spending between 2023–24 and 2025–26 is largely based on the profile of funds approved to strengthen Canada's AML/ATF Regime, which will enable FINTRAC to modernize its tools and processes, build capacity in evolving threat areas, protect its intelligence and information, preserve its supervisory capacity, and expand its operations.Budgetary performance summary for core responsibilities and Internal Services (dollars)

The "Budgetary performance summary for core responsibilities and internal services" table presents the budgetary financial resources allocated for FINTRAC's core responsibilities and for internal services.

| Core responsibilities and Internal Services | 2022–23 main estimates |

2022–23 planned spending |

2023–24 planned spending |

2024–25 planned spending |

2022–23 total authorities available for use |

2020–21 actual spending (authorities used) |

2021–22 actual spending (authorities used) |

2022–23 actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | $23,907,929 | $25,206,629 | $30,819,567 | $32,130,619 | $30,946,697 | $19,944,414 | $25,359,149 | $27,692,974 |

| Production and dissemination of financial intelligence | $19,587,477 | $20,662,132 | $25,102,235 | $28,266,275 | $21,564,986 | $17,373,037 | $20,558,417 | $22,877,752 |

| Subtotal | $43,495,406 | $45,868,761 | $55,921,802 | $60,396,894 | $52,511,683 | $37,317,451 | $45,917,566 | $50,570,726 |

| Internal Services | $31,492,123 | $32,916,135 | $60,572,895 | $56,028,736 | $43,211,040 | $24,393,503 | $31,110,709 | $37,582,653 |

| Total | $74,987,529 | $78,784,896 | $116,494,697 | $116,425,630 | $95,722,723 | $61,710,954 | $77,028,275 | $88,153,379 |

Actual spending (2021–22 to 2022–23)

Actual spending in 2022–23 was $88.2M. This is an increase of $11.2M compared to the 2021–22 spending of $77.0M. The increase in expenditures was primarily due to the following:

- Personnel expenditures increased by $5.1M in 2022–23 following an increase in the number of full-time equivalents.

- Expenditures for transportation and communications increased by $2.1M in 2022–23. Expenses increased with respect to data communication services.

- Increases in spending for the acquisition of equipment, information and rental.

- Increases in spending for repair and maintenance was offset by decreases in expenses related to utilities and professional services.

Planned spending (2023–24 to 2025–26)

Planned spending is expected to increase by $28.3M to $116.5M in 2023–24. In 2024–25, expenditures are anticipated to be slightly lower in 2023–24, with only a decrease of $0.1K to $116.4M. The increase in planned spending in 2023–24 and 2024–25 is largely based on the profile of funds announced in Budget 2022 to strengthen Canada's AML/ATF Regime. FINTRAC is currently undertaking an exercise to review its attribution of Internal Services and identify the full costs of its Compliance Program, which is anticipated to be cost recovered beginning April 1, 2024.

Human resources

The "Human resources summary for core responsibilities and internal services" table presents the full-time equivalents (FTEs) allocated to each of FINTRAC's core responsibilities and to internal services.

Human resources summary for core responsibilities and Internal Services

| Core responsibilities and Internal Services | 2020–21 actual full-time equivalents | 2021–22 actual full-time equivalents | 2022–23 planned full-time equivalents | 2022–23 actual full-time equivalents | 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | 138 | 173 | 146 | 180 | 179 | 152 |

| Production and dissemination of financial intelligence | 111 | 131 | 133 | 137 | 154 | 154 |

| Subtotal | 249 | 304 | 279 | 317 | 333 | 306 |

| Internal Services | 141 | 179 | 189 | 209 | 236 | 224 |

| Total | 390 | 483 | 468 | 526 | 569 | 530 |

FTEs have increased from 483 in 2021–22 to 526 in 2022–23. Actual FTEs in 2022–23 exceed planned FTEs for 2022–23 by 58 FTEs. These FTEs are funded by Budget 2022 and Budget 2019 to strengthen Canada's AML/ATF Regime, Budget 2021 to develop virtual currency expertise, supervision of armoured car companies, and the implementation of a cost recovery funding model for FINTRAC's Compliance Program, the July 2020 Economic and Fiscal Snapshot to fight financial crime and modernize the cross-border currency reporting framework, and for FINTRAC to contribute to the national strategy to combat human trafficking. The funding profile from these initiatives, as well as the ending of temporary funding over the reporting period result in FTEs decreasing to 465 in 2023–24 and in 2024–25.

Expenditures by vote

For information on FINTRAC's organizational voted and statutory expenditures, consult the Public Accounts of Canada.

Government of Canada spending and activities

Information on the alignment of FINTRAC's spending with Government of Canada's spending and activities is available in GC InfoBase.

Financial statements and financial statements highlights

Financial statements

FINTRAC's financial statements (unaudited) for the year ended March 31, 2023, are available on the department's website.

Financial statement highlights

| Financial information | 2022–23 planned results |

2022–23 actual results |

2021–22 actual results |

Difference (2022–23 actual results minus 2022–23 planned results) |

Difference (2022–23 actual results minus 2021–22 actual results) |

|---|---|---|---|---|---|

| Total expenses | $82,045,334 | $91,238,857 | $79,902,306 | $9,193,523 | $11,336,551 |

| Total revenues | $0 | $748 | $0 | $748 | $748 |

| Net cost of operations before government funding and transfers | $82,045,334 | $91,238,109 | $79,902,306 | $9,192,775 | $11,335,803 |

Actual expenses (2021–22 to 2022–23)

In 2022–23, actual expenses were $91,238,857. This is an increase of $11,336,551 compared to 2021–22 expenses of $79,902,306. The variance is primarily due to:

- An increase in salaries and employee benefits of $7,189,142 due to an increase in the number of FTEs on strength.

- An increase in rentals of $1,161,387 is due in large part because of increased expenses for photocopier rentals and software license/maintenance fees.

- Transportation and telecommunication expenses increased by $1,499,811 due to increased expenses for image/video communications service and courier expenses.

- Further increases are related to the acquisition of machinery and equipment, travel and relocation and information services.

Actual revenues (2021–22 to 2022–23)

In 2021–22, actual revenues were $0. In 2022–23, FINTRAC recoded actual revenues of $748. An increase due to the sale of Crown Assets.

The 2022–23 planned results information is provided in FINTRAC's Future-Oriented Statement of Operations and Notes 2022–23.

| Financial information | 2022–23 | 2021–22 | Difference (2022–23 minus 2021–22) |

|---|---|---|---|

| Total net liabilities | $14,483,303 | $11,624,942 | $2,858,361 |

| Total net financial assets | $10,527,506 | $7,503,495 | $3,024,011 |

| Departmental net debt | $3,955,797 | $4,121,447 | $-165,650 |

| Total non-financial assets | $6,471,918 | $4,960,516 | $1,511,402 |

| Departmental net financial position | $2,516,121 | $839,069 | $1,677,052 |

Actual total net liabilities (2021–22 to 2022–23)

In 2022–23, total net liabilities were $14,483,303. This is an increase of $2,858,361 compared to 2021–22 total net liabilities of $11,624,942.

Actual total net financial assets (2021–22 to 2022–23)

In 2022–23, total net financial assets were $10,527,506. This is an increase of $3,024,011 compared to 2021–22 total net financial assets of $7,503,495. The increase primarily consists of the following:

- An increase in the amount due from the Consolidated Revenue Fund of $2,876,755, resulting from an increase in liabilities, such as accounts payable and accrued salaries.

Actual departmental net debt (2021–22 to 2022–23)

In 2022–23, departmental net debt was $3,955,797. This is a decrease of $165,650 compared to 2021–22 departmental net debt of $4,121,447 due to the changes in liabilities and financial assets described above.

The 2022–23 planned results information is provided in FINTRAC's Future-Oriented Statement of Operations and Notes 2022–23.

Corporate information

Organizational profile

Appropriate minister: The Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance

Institutional head: Sarah Paquet, Director and Chief Executive Officer

Ministerial portfolio: Finance

Enabling instrument(s): Proceeds of Crime (Money Laundering) and Terrorist Financing Act, S.C. 2000, c. 17. (PCMLTFA)

Year of incorporation / commencement: 2000

Raison d'être, mandate and role: who we are and what we do

"Raison d'être, mandate and role: who we are and what we do" is available on FINTRAC's website.

Operating context

Information on the operating context is available on FINTRAC’s website.

Reporting framework

FINTRAC's departmental results framework and program inventory of record for 2022–23 are shown below.

Departmental Results Framework

Core Responsibility 1: Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

-

Departmental Result: Reporting entities are compliant with their anti-money laundering and anti-terrorist financing obligations and requirements

- Indicator: Percentage of assessed reporting entities not requiring enforcement action

- Indicator: Percentage of Financial Transaction Reports submitted to FINTRAC that meet validation rules as an indicator of quality

Internal Services

Core Responsibility 2: Production and Dissemination of Financial Intelligence

-

Departmental Result: FINTRAC's tactical financial intelligence informs investigative actions

- Indicator: Percentage of feedback from disclosure recipients that indicate that FINTRAC's financial intelligence disclosure was actionable

-

Departmental Result: FINTRAC's strategic financial intelligence informs policy and decision making

Indicator: Percentage of Regime partners utilizing FINTRAC products to inform activities

Program inventory

Program: Compliance Program

Program: Strategic Policy and Reviews

Program: Financial Intelligence Program

Program: Strategic Intelligence Research and Analytics

Supporting information on the program inventory

Financial, human resources and performance information for FINTRAC's program inventory is available in GC InfoBase.

Supplementary information tables

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Organizational contact information

Mailing address

Financial Transactions and Reports Analysis Centre of Canada

234 Laurier Avenue West

Ottawa, Ontario K1P 1H7

Canada

Telephone: 1-866-346-8722 (toll free)

Fax: 613-943-7931

Email: guidelines-lignesdirectrices@fintrac-canafe.gc.ca

Website: https://fintrac-canafe.canada.ca/intro-eng

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- Core Responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a 3 year period. Departmental Plans are usually tabled in Parliament each spring.

- departmental priority (priorité)

- A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

- departmental result (résultat ministériel)

- A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A quantitative measure of progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- full time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person year charge against a departmental budget. For a particular position, the full time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives; and understand how factors such as sex, race, national and ethnic origin, Indigenous origin or identity, age, sexual orientation, socio-economic conditions, geography, culture and disability, impact experiences and outcomes, and can affect access to and experience of government programs.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2022–23 Departmental Results Report, government-wide priorities are the high-level themes outlining the government's agenda in the November 23, 2021, Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation; and fighting for a secure, just and equitable world.

- horizontal initiative (initiative horizontale)

- An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non-budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

- The process of communicating evidence based performance information. Performance reporting supports decision making, accountability and transparency.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

- For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.